BMAN21020A는 Accouitng 계열 듣는 친구들은 필강이다. 아니면 Finance 듣는 친구들도 들을 거다. 이 수업은 진짜 진짜 할게 많다,,,, 근데 또 도움은 많이 된다. 할 거도 외울 것도 많지만 그만큼 기초과목이랄까 ㅋㅋㅋㅋㅋ.

Revision을 똑바로 끝내야 1학기 진도가 나갈 정도로 Revision은 중요하다. 아마 1학년 1학기 때 Financial Reporting 수업 듣고 이거 들을 쯤엔 기억이 안 날 거다. 나도 그랬다 ㅋㅋㅋㅋ,,,

이 Revision은 일단 보면 녹강이 진짜 많다. 3시간은 봐야 할정도? 근데 교수님 말씀 하나하나가 정보라서 다 적어야 한다는 함정. 녹강 듣고 풀어야 하는 문제가 한 10개 이상 될 거다. 그거도 다 풀어야 시험준비가 가능하다 ^^^^^^. 한 문제당 5페이지씩은 있으니 꼬박 1주일은 써야 한다는 점. Revision에 엄청 새로운 내용은 안 들어있지만 Ledger, T-account라는 개념이 좀 생소하다. 이게 뭐야 하고 띄어 넘으면 다시 봐야 하니 하나하나 꼼꼼히 보시길.

무튼 정리해놨으니 도움이 되면 좋겠다. 파이팅!

Accounting: a series of processes and techniques used to identify, measure, and communicate economic information that users find helpful in making informed decisions.

| Asset | Liability | Equity |

| - Present economic recourse (right) - Control [Control is possible without legal ownership] :법적 소유권이 없더라도 계약, 합의, 라이선싱과 같은 방법으로 자산을 통제 할 수 있다. 특정 자산을 사용하거나 운영할 권리를 가질 수 있다. - Future economic benefit due to past events A resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity |

- Present obligation to transfer an economic resource

- Past event - Expected outflow of resources → to persons/entities other than the owner A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits (ex) loan, bank overdraft, trade payables (creditors), accruals (paid in arrears)

“Possible: expect to arise with certainty.”

|

- Claim on business by Owners

- Residual interest in assets after deducting all its liabilities - Residual interest in net assets (E=A-L) Winding up means

1. sell all assets to get cash 2. pay off all liabilities 3. what’s left: goes to the owners |

Income (Revenue)

- Increase in Economic Benefit from Revenue

- Gains during the accounting period that increase Equity, other than contributions from the owners

- Revenue / Non-Operating Income로 나뉜다.

Issue* Recognition 언제 할 건가?

- Contract in place

- A “Performance obligation” is met 📣 물건을 넘겼을 때, ownership of goods has passed to the customer.

- Measured reliably, probable outcome = Revenue received

‼️ “CASH를 받았을 때가 아닌, 물건을 넘겼다면 Recognise REVENUE.” ‼️

Expecting to get cash in later or now, but there is a risk of bankruptcy of customers (Bad debts)

Expense

- Decreases in Economic Benefits from Expenses incurred in ordinary business

- Losses that arise during the accounting period that decrease equity, other than distributions to the owners

- Expenses from Ordinary Business Operations (day-to-day business)

: COS, rent, insurance, heating & lights, wages & salaries - Non-operating Losses (cost of funding)

: Interest, Loss on disposal NCA

Basic accounting equation

Dual Effect → A이 되기 위해선 either comes fromExternal claim (L) or Internal claim (E)

Illustration -1)

Fela starts a business selling hats on eBay

- He begins the business with $1000 cash from his savings.

- He opens a bank account for the business and deposits $500.

| Asset | Liability | Equity |

| - Cash $500 - Bank $500 |

- Capital $1000 |

⬇️ He buys 100 hats for $3 each (total amount is $300 cash), hoping to start trading nxt wk.

| Asset recognition: control, past event, future economic benefit |

| Asset | Liability | Equity |

| - Cash $200 - Bank $500 - Inventory $300 |

- Capital $1000 |

Accounting period

보통 1년을 회계 기간이라고 정의.

Financial performance in period (P/L)

Financial position at the end of the period (SOFP)

Illustration-2)

In wk2, Fela begins selling his hats on eBay:

- He sells 40 of his inventory of hats for $6.50 each, for cash (total received: $260). [Inventory: cost of each hat is $3].

Income Statement (for wk2)

Revenues: Sales (40 hats x $6.50) 260

Less: Cost of Sales (40 hats x $3) (120)

—————————————————

Profit in week 140

Brought Froward (opening) Balances X

Movement in the period (X)

__________________________________

Carried Forward (Closing) Balances X

Material items are influential to the decision-maker

Immaterial items have no influence on the decisions of users

Single cash book의 문제점은 non-cash items를 보여주지 않는다는 것.

Assets = Liabilities + [Income - Expenses - Drawings] → Retained earnings + Opening equity

P/L format

R X

CoS (X)

GP X

OE (X)

OP X

Non-OE (X)

NP X

Sales Ledger

The Cash Book - Nominal Ledger - Journal (FP)

Nominal ledger 안에는 trade receivables, revenue, bad debts 기타 등등 각각의 account별로 페이지를 만드는 거야.

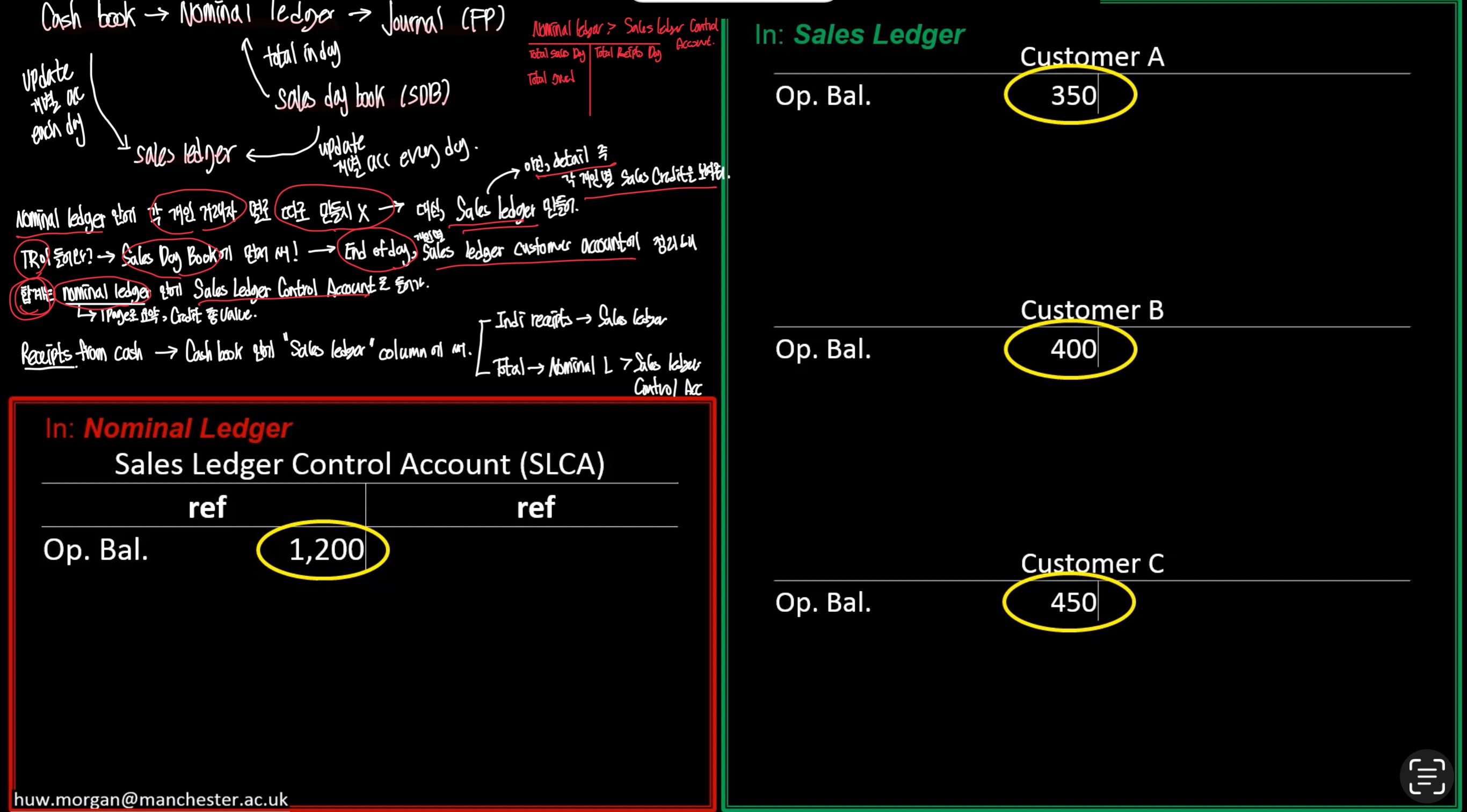

Rather than recording all the individual customer accounts in the nominal ledger, a separate ledger - Sales Ledger - will be maintained. Every time a sale on credit is made, it is first recorded in a Sales Day Book, from which postings are made at the end of the day to the individual Sales Ledger customer accounts, and also in total to the Nominal Ledger in an account often called a "Sales Ledger Control Account." The summarized version of the total amounts owed by customers will be maintained on one page in the Nominal Ledger, alongside the detailed records of the Sales Ledger.

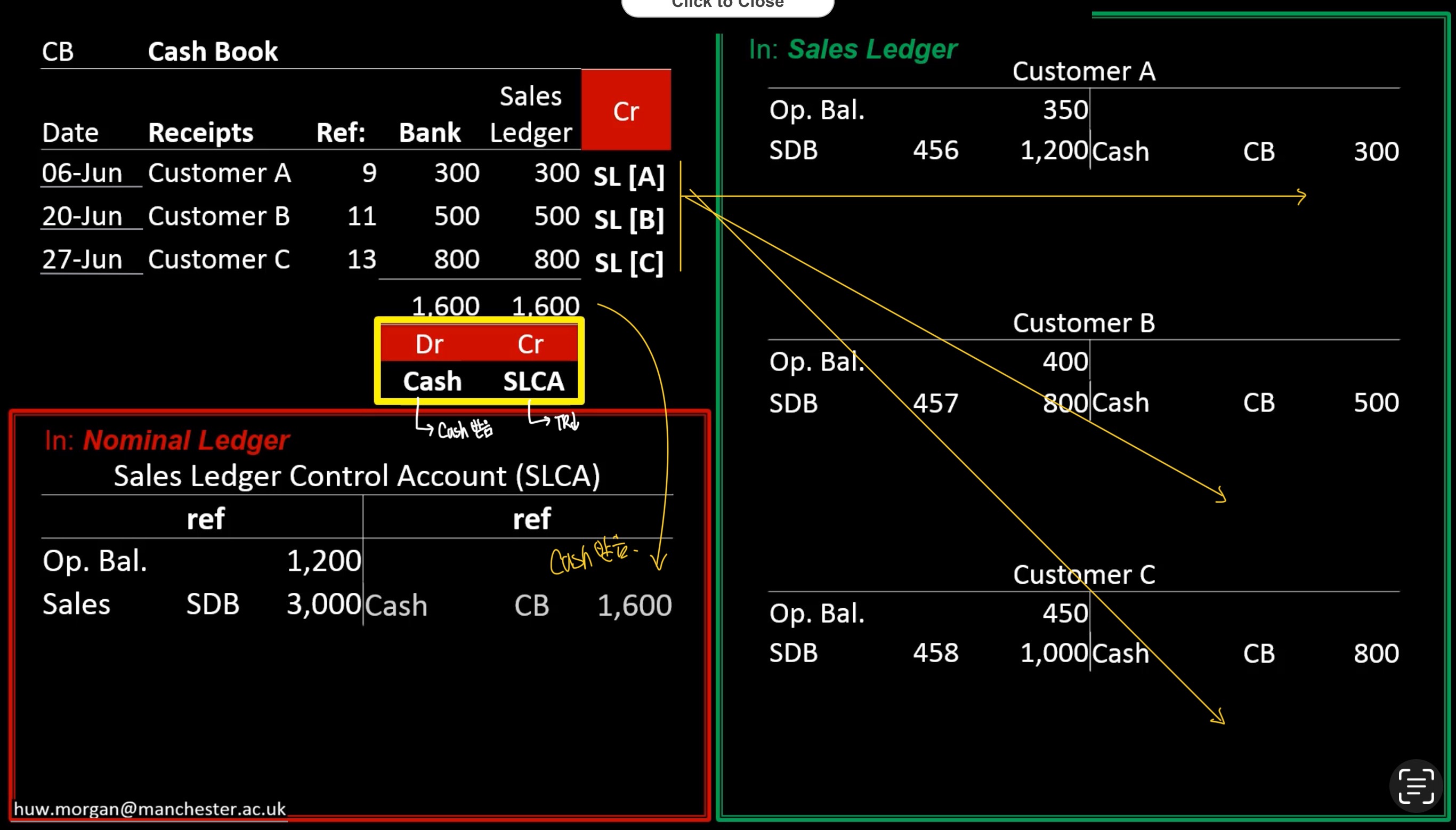

As for any receipts from credit customers, these will first be recorded in the cash receipts book, in a separate "Sales Ledger" column. The individual receipts are credited to the relevant customer account in the Sales Ledger, while the total receipts for the day will be credited to the Sales Ledger Control Account. This dual recording of transactions with credit customers on an individual basis in the Sales Ledger and in total in the Nominal Ledger allows for control or checking. This is why the Nominal Ledger's total summary is known as the Sales Ledger Control Account. If you add up all of the individual balances in the Sales Ledger at the end of the day, this should equal the total balance outstanding in the Sales Ledger control account.

Sales ledger ← update individual accounts each day ← sales day book

Nominal ledger ← Total in day ← Sales day book

The cash book ← Nominal Ledger

Sales Ledger ← Update individual accounts each day ← The cash book

Sales ledger control account

Illustration

Illustrate how the sales ledger and the sales ledger control account in the nominal ledger operate.

Shuan has been offering credit terms with 3 of his customers (A, B, C), At the end of the day total owed = 1200.

This total is represented within the nominal ledger under the Sales Ledger Control Account (outlining the total amounts expected from Trade Receivables). To keep track of specifically how this asset is represented per customer, Shuan operates a sales ledger, with a separate account recording the transaction with each customer.

The total of the sales ledger adds up to the opening balance on the sales ledger control account.

By end of the June, Shuan has sold more goods on credit to each customer. These sales are recorded in the Sales Day Book, the book of prime entry for Sales on credit.

Each entry is then posted to the the relevant customer account in the Sales Ledger so that a record is kept of who owes Shuan what - which is of course vital to ensure ultimate recovery of the money from the customer.

In the Nominal (or general) ledger, the total sales on credit is entered into the sales ledger control account, with a correspondiing entry into the sales acccount (not shown here).

This double entry into the nominal ledger will be a part of the finanicla statements - entries into the sales ledger are merely a memorandum: additional information to aid Shuan in administering credit control.

In addition to sales, Shuan will of course be expecting recipts from his customers to settle their debts. Cash was received in June from customers A, B, and C, and these are included in the receipts side of Shuan’s cashbook: which in this case has a separate column for Sales Ledger receipts.

The individual recipts are posted into the individual accounts within the sales ledger, and the total receipts are posted to the sales ledger control account, as part of the double entry which updates the nominal ledger. This reduction in trade receivables arises because of the increase in cash.

At the end of the month, the nominal ledger accounts are closed down as are the individual accounts in the Sales Ledger.

A check (an “Internal Control”) can then be made to see whether entries have been recorded correctly: the closing balance in the Sales Ledger control account, brought down to start the next month, should be the same as the totals brought down in each accounts int he Sales Ledger.

Intangible assets

For example, the business has a good customer base and uses secret recipes that he believes are of value to the business: they should provide future economic benefit. Potentially Intangible assets, non-monetary assets without physical form - but can they be recorded in the financial statements? To be included as an asset, the item must meet the definition of an asset and recognition criteria.

Asset definition

- Present economic resource

- control

- past event

- future economic benefits

Recognition

- probable inflow

- reliable measure

- Separable from the business

*Under control of business is not a requirement for an asset to be recognized.

Control is not a requirement for recognition, but a part of the definition of an asset. Some assets that meet the definition can't be recognized without a probable inflow of benefits, that can be measured reliably and separable from the business (unlike goodwill).

회계에서 자산을 인식하는 데 있어서 '통제'가 필수적인 조건은 아니지만 자산의 정의에는 핵심적인 부분.

자산이 회사에 직접적으로 통제되지 않더라도 인식될 수 있다는 것을 강조, 미래 혜택의 발생이 확실하고 신뢰성 있게 측정 가능하며, 비즈니스로부터 분리될 수 있어야 한다.

Goodwill(자산 가치)과 같은 특정 자산이 이러한 추가 조건을 충족하지 못할 수 있다.

회계 원칙에 따르면 자산의 인식은 직접 통제에 의해만 이루어질 필요는 없습니다. 이는 다양한 형태의 자산이 회사의 직접적인 통제 속에 있지 않더라도, 회사에 혜택을 제공하거나 경제적 가치를 지닐 경우에도 해당 자산을 회계 정보에 포함시킬 수 있다.

여러 이유로 직접 통제가 불가능한 자산이 있을 수 있습니다.

예를 들면:

- 무형 자산 (Intangible Assets): 브랜드 가치, 특허, 저작권과 같은 무형 자산은 종종 직접 통제하기 어려운데, 그러나 이러한 자산이 회사의 가치에 기여하고 경제적 이익을 창출할 수 있습니다.

- 공동 소유 형태의 자산 (Jointly Controlled Assets): 회사가 다른 조직 또는 당사자와 자산을 공동으로 소유하는 경우가 있을 수 있습니다. 이런 경우에도 직접적인 통제는 모호할 수 있지만, 경제적 이익을 가져오는 자산으로 여겨질 수 있습니다.

- 금융 자산 (Financial Assets): 주식, 채권과 같은 금융 자산은 종종 회사가 직접 통제하기 어렵지만, 이로부터 예상되는 현금 흐름이나 혜택이 있을 수 있습니다.

-

- Amount Paid for the Business:

- This refers to the total consideration, usually in monetary terms, that a buyer pays to acquire the business. This amount includes not only the tangible assets and liabilities on the balance sheet but also the perceived value of intangible assets.

- Value of Net Assets in the Statement of Financial Position:

- This represents the total value of the business's tangible and intangible assets, minus its liabilities, as reflected in the statement of financial position (or balance sheet).

- Excess Amount:

- The difference between the amount paid for the business and the value of its net assets represents the excess amount. This excess is often attributed to intangible assets, and specifically, in this context, to goodwill.

- Goodwill:

- Goodwill, in accounting, represents the intangible value of a business that is not directly attributable to its identifiable tangible assets or liabilities. It includes factors such as customer loyalty, brand value, reputation, and other intangible elements that contribute to the business's earning power.

In summary, the statement is saying that when a business is sold, and the buyer pays more than the net value of its assets and liabilities, the excess amount is recognized as goodwill. Goodwill is considered an intangible asset and is only properly valued when a transaction, such as a business sale, occurs. This is one reason why financial statements may not fully reflect the market value of a business, as the value of goodwill is often more accurately assessed through market transactions.

- Goodwill, in accounting, represents the intangible value of a business that is not directly attributable to its identifiable tangible assets or liabilities. It includes factors such as customer loyalty, brand value, reputation, and other intangible elements that contribute to the business's earning power.

- Amount Paid for the Business:

Characteristics of Accounting information

Fundamental Qualitative Characteristics

- Relevant: Materiality, Predictive, Confirmatory

Capable of making a difference in the decisions made by the users.

The key to thinking about relevant to users is materiality.

Material information is defined as information whose omission or misstatement would influence the decision of the user. If we don’t provide it, it may affect the quality of decisions.

Likewise, giving information that is not material may impair the usefulness of the total information given. Relevant information must be used to predict future outcomes, or to confirm or alter previous evaluations. For example, Sales information in the year can be used to predict future sales, and also confirm and evaluate previous years’ sales budgets. So predictive and confirmatory values are interrelated.

- Faithful: Materiality, Neural, Error-free, Complete

Accurately represent the effect of economic activities. Information is faithful if it is neutral - unbiased and not weighted, emphasized, or manipulated. It should be free from error. This doesn’t mean it’s 100% accurate: but rather there are no material errors or omissions that may mislead the users. Finally, faithful information will include all the material information needed to make decisions, so it must be complete.

Revaluation to Fair (Market) Value

- Relevant

1. Fair value more relevant

2. Better-informed for decisions

3. eg: Lenders: Security

- Faithful (Reliable)

1. Faith value: less reliable

2. Needs to be free from bias

3. Historic cost is not estimated

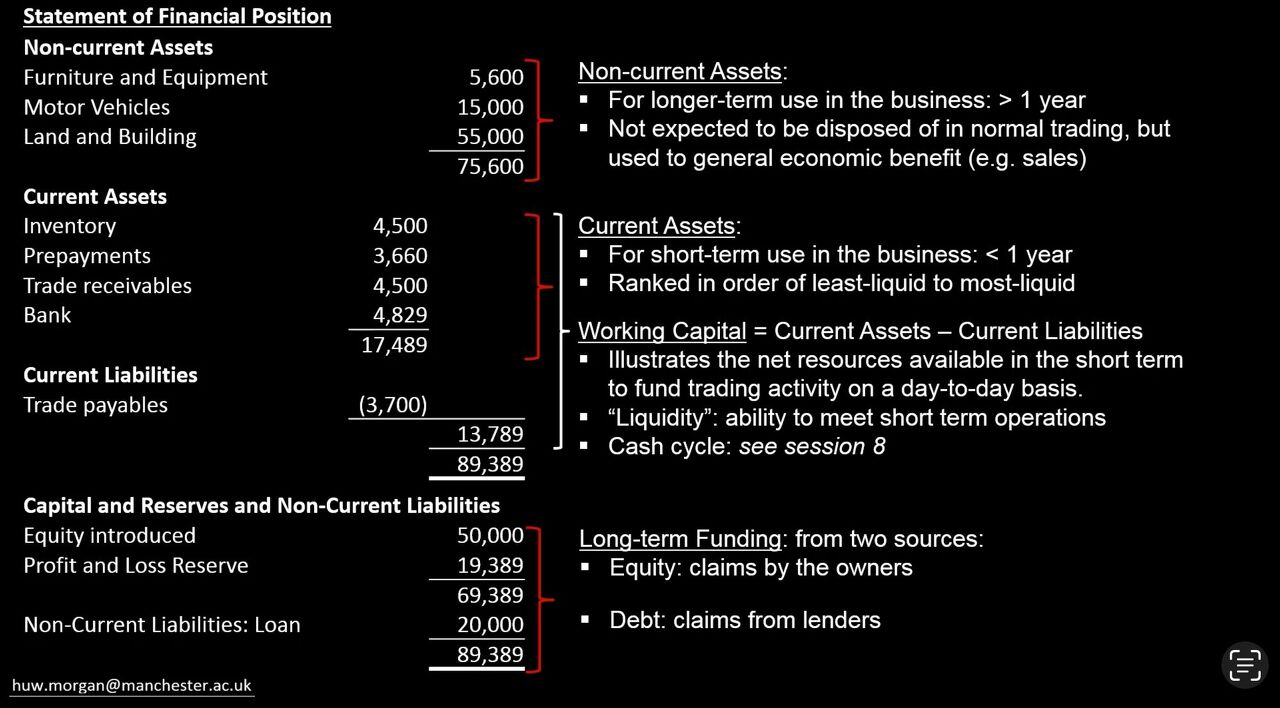

Whilst certain aspects of Shuan’s business such as goodwill may not be included in the financial statements, because of lack of faithful representation, Shuan may choose to report the value of NCA - mainly Land & buildings - at fair value (or market value) rather than at historical cost (the cost at which the asset was acquired and initially reported). As a sole trader, there may be little need to be this, but as the business grows, and with it the users of the financial statements, the relevance of Fair value to decision-making does too. Showing the Land and Buildings at market value (where values are rising) provides more relevant information on the true wealth or value of the business; for example, potential lenders can make better-informed decisions on the value of assets that could be used as security. On the other hand, a fair value requires an element of estimation - even where an expert is used - and has a lower level of reliability compared to the historic cost of the asset which is proven by the physical payment.

Impairment

- Carrying value = Value reported in Financial Statement (NBV)

Asset은 2 종류로 나뉘어

1. Use - Value in use

2. Sell - (Fair value - any selling costs)

- If higher of these choices: “Recoverable amount”

- If carrying value > Recoverable amount:

Impairment Reduce asset value by difference Show the difference as loss in the income statement

It may be that the fair value of the asset has fallen since it was acquired - particularly in the case of land and buildings bought before the 2007 financial crisis: in which case there is a coa mpulsory requirement to perform an impairment review. An impairment adjustment arises when the carrying value (the net book value) is no longer representative of the future economic benefit that will be generated by it. In simple terms, an asset is held by a business for two reasons: either to be kept for use in the business or to be sold. When kept for use, the “value in use” represents the future net cash inflows at today’s prices that the asset is expected to generate. The fair value net of any selling costs would represent the value of selling it. The “recoverable amount” is the higher of these two amounts, which would be the logical choice - and if this is lower than the carrying value, we have an impairment. It would be contrary to the qualitative characteristics of financial reporting to ignore an impairment as this would reduce the relevance and the faithfulness of the financial statements. So adjustment would be required to “write down” the asset from its carrying value to recoverable amount, with the loss being shown in the income statement and resulting in a reduction in equity.

ex) An asset is being depreciated using a 40% reducing balance method, and cost $10,000 exactly two years ago. An impairment review reveals its estimated value in use at $2,600 and it could be sold now for $3,000 although this would incur selling costs of 300. What is the impairment charge? : NBV after 2 years using RB method would be 3,600 (10,000-4000-2400). The recoverable amount is: higher than ViU (2600) and NRV (3000-300) = 2700. so, impairment is 3600-2700=900

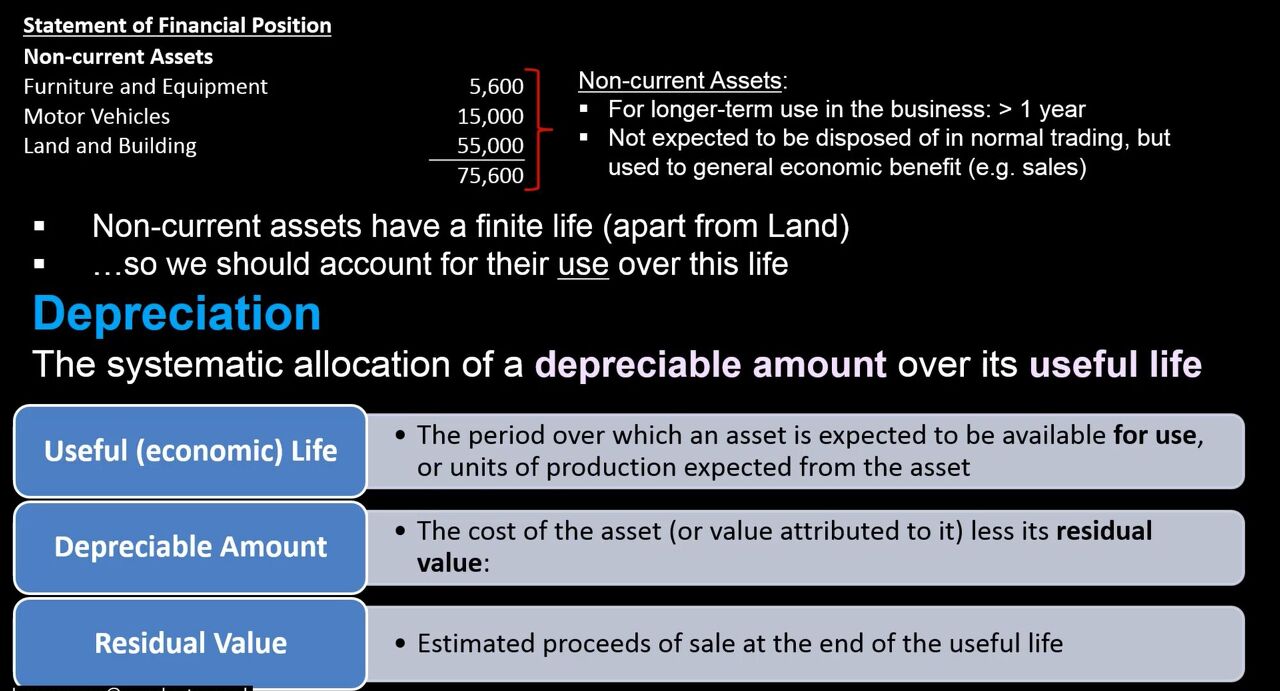

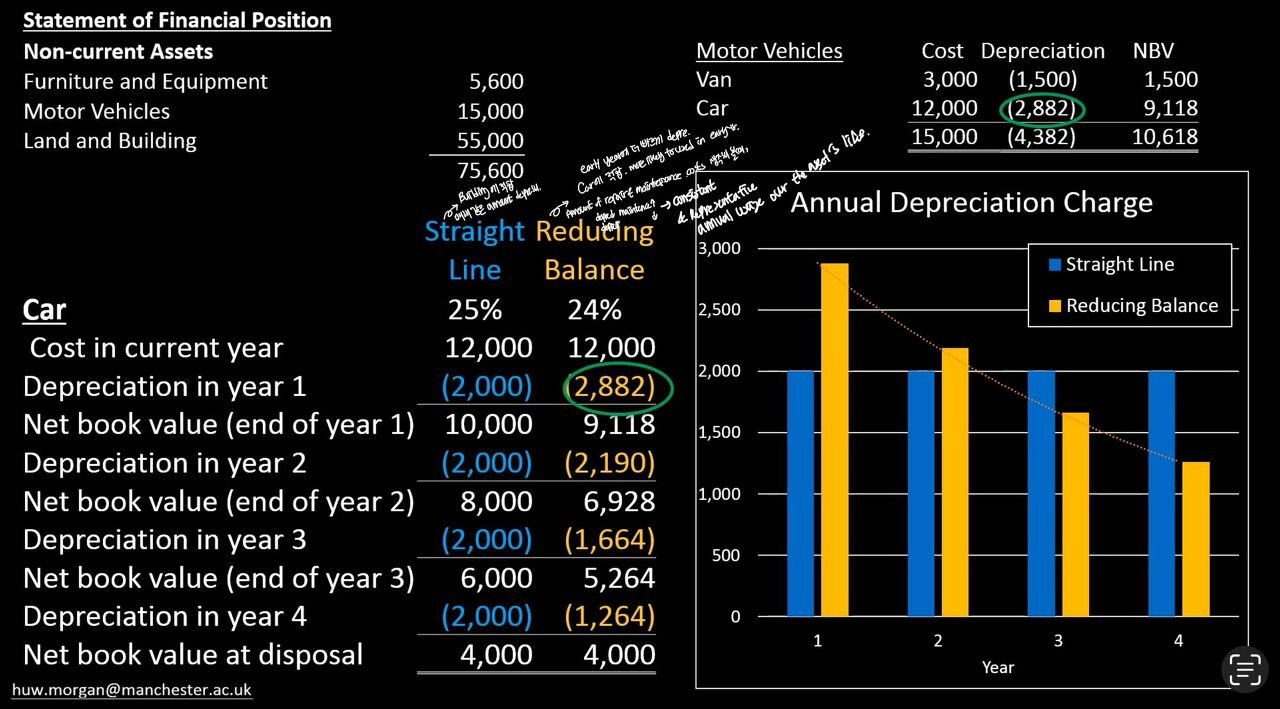

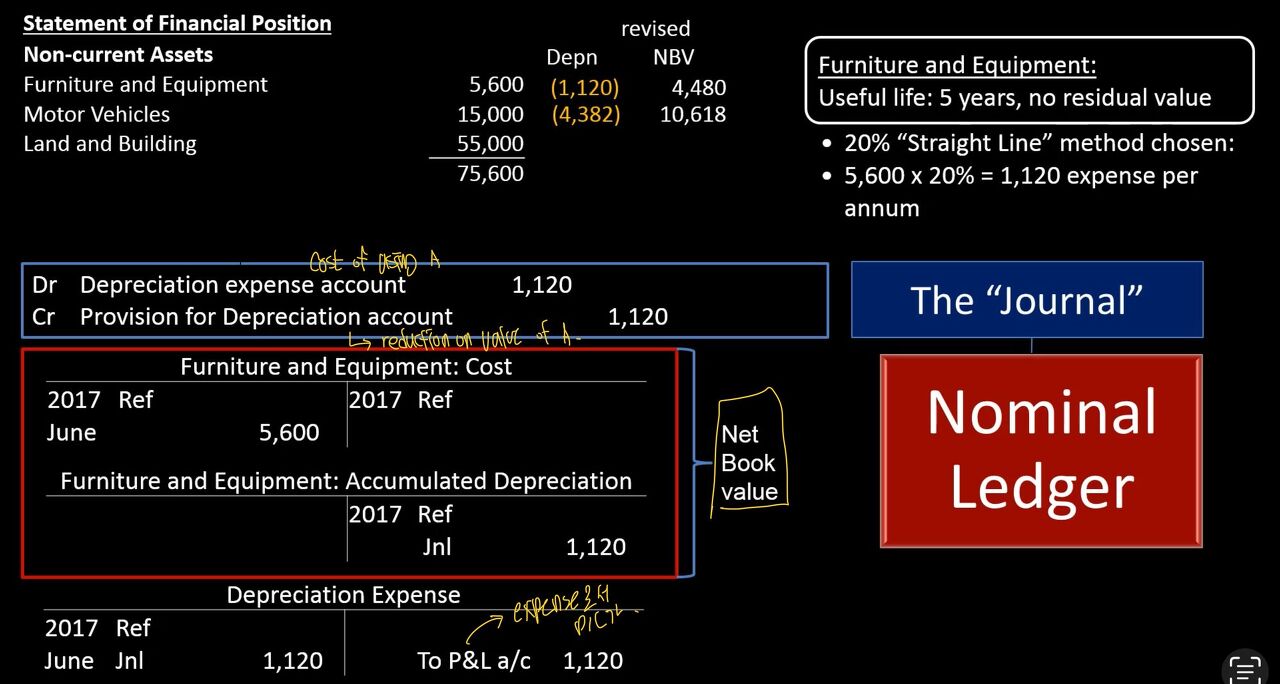

Depreciation

Illustrate the accounting entries into the nominal ledger.

Since depreciation adjustments involve no cash, the initial recording of these items will be in the journal, where a record is made of the two accounts that are affected.

Dr. Depreciation expense account 1120

Cr Provision for Depreciation account 1120

In this case, the expense account for depreciation is debited, to show the cost of using the assets, and the reduction in the value of the asset is recorded by crediting a provision for depreciation account in the assets section of the nominal ledger. We don’t deduct (or offset) this directly from the cost as more information is available: the initial cost and the amount utilized so far. These two accounts then represent the net book value of the assets. At the end of the financial year, the depreciation expense account will be “closed down”, with the expense being transferred into the P/L account. The accumulated depreciation account will however remain, representing historic costs, and will grow each year as more depreciation is accounted for as the asset is used further.

Accruals (Matching)

- Transactions are recognized when they occur, rather than when cash is received/paid.

- Report transactions in periods to which they relate.

Going Concern

- Presumes business will continue indefinitely

- “Foreseeable future”, will operate for the next 12 months

- If presumption invalid: use “break-up” basis.

Consistency

- To ensure comparability of accounting information

- Transactions are classified into groups according to their economic characteristics

The going concern assumption is that a business will continue to operate indefinitely, without any plans to stop trading for the foreseeable future (assumed to be more than a year). If the business is struggling to the point that the going concern is invalid, then the business’s assets may well have lower values than reported as a going concern — and an impairment review may be required. An inactive or failing business that is about to cease trading is not a going concern. Instead, the business will be “wound up” by liquidating its assets - selling them off to repay its liabilities and then returning any residual interest to the owners. Selling off assets quickly may mean the business receives less than the values reported in the financial statements, so these will need to be adjusted - impaired - to the amounts they can be sold for (or net realized value). This is what we call the “break-up” basis. Users expect to receive comparable accounting information so that they can compare a business’s performance and position against itself in prior periods, or against competing businesses in similar periods. To ensure comparability, Consistency means transactions are classified into groups according to their economic characteristics: the elements of assets, liabilities, and equity. The reporting of assets and liabilities as either current or non-current should be applied consistently so that comparisons are valid. Another example is to ensure that NCA is valued on a consistent basis - either using the Historic cost convention or Fair value and not changing this basis year-on-year.

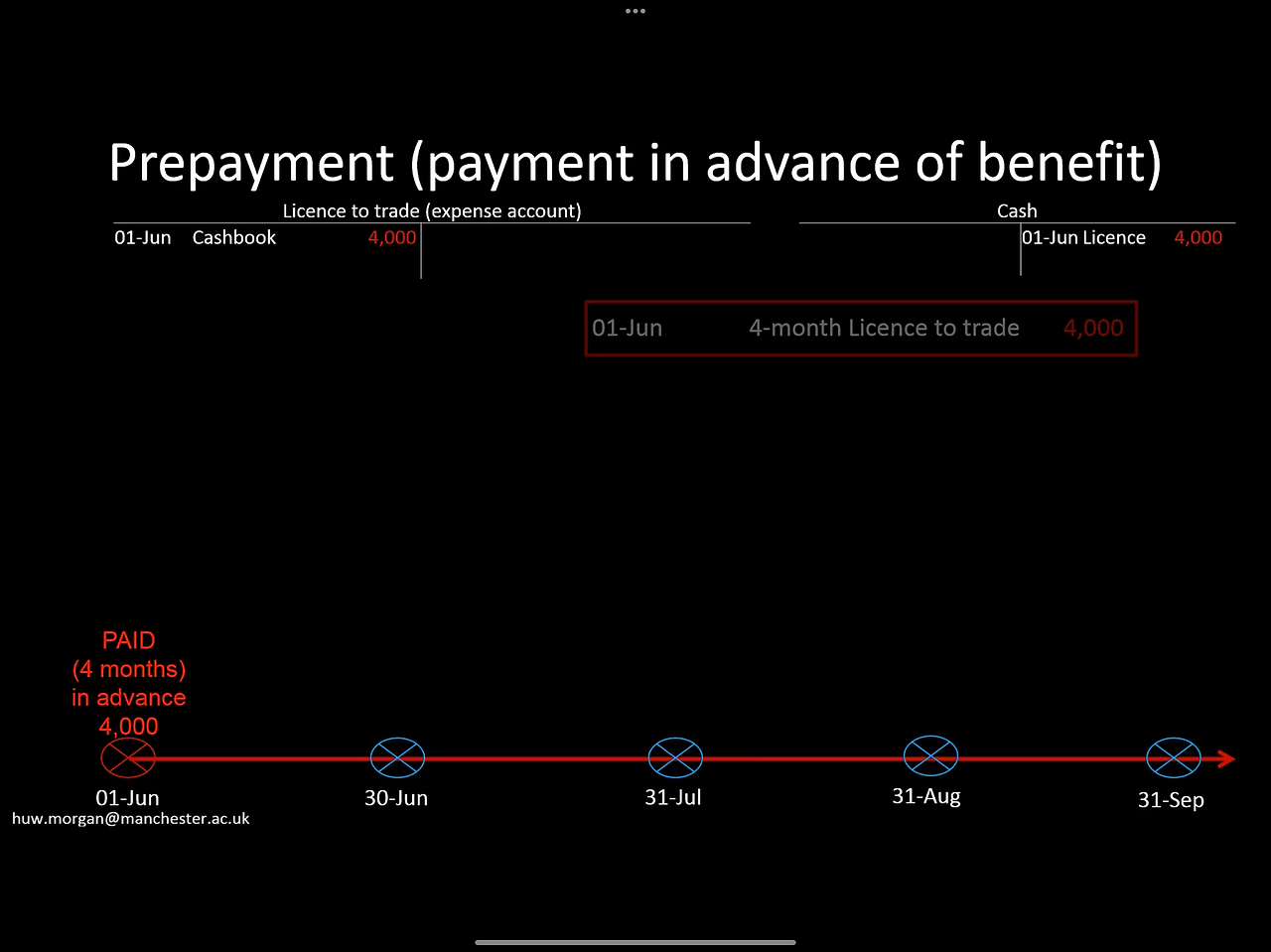

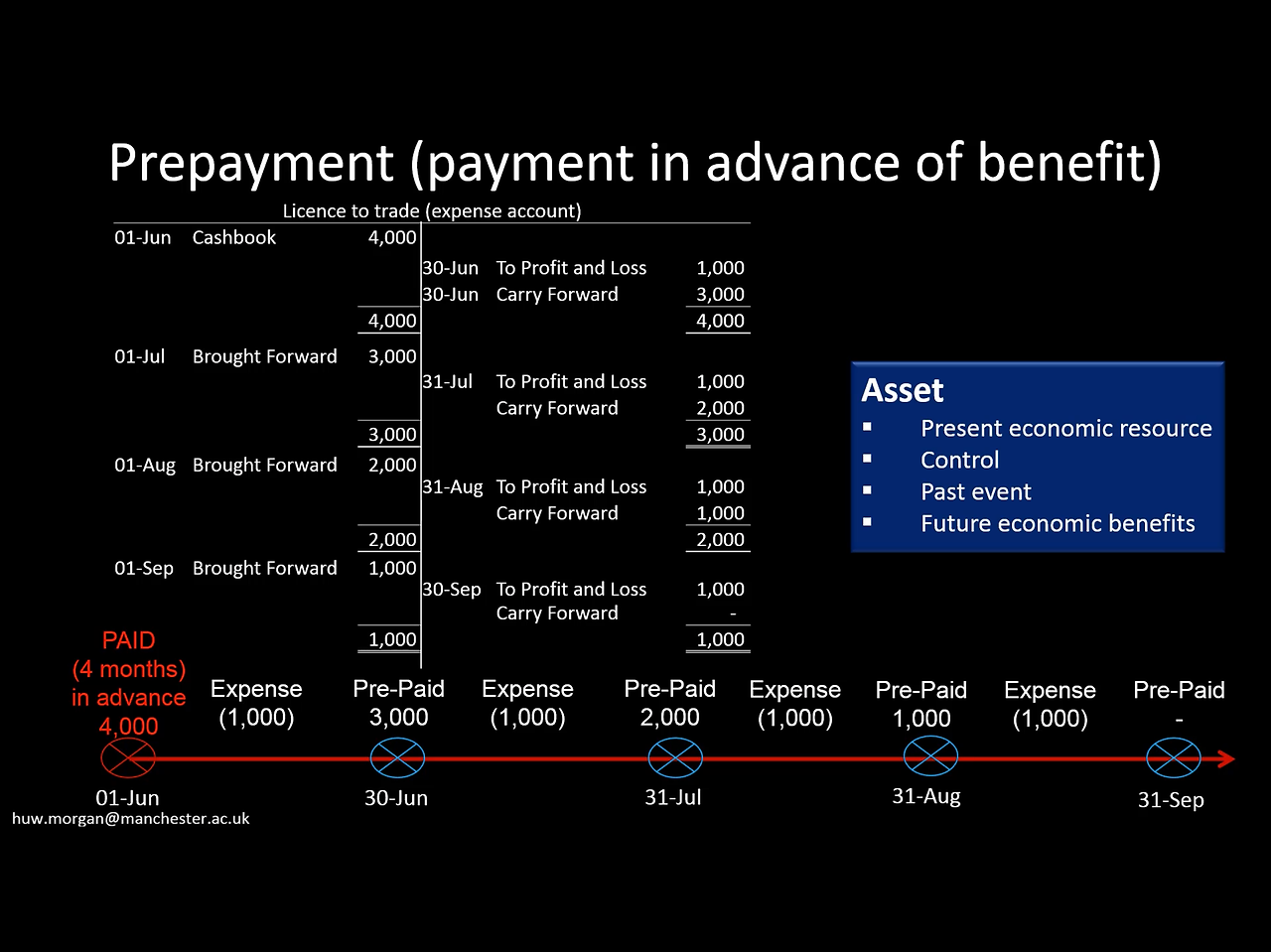

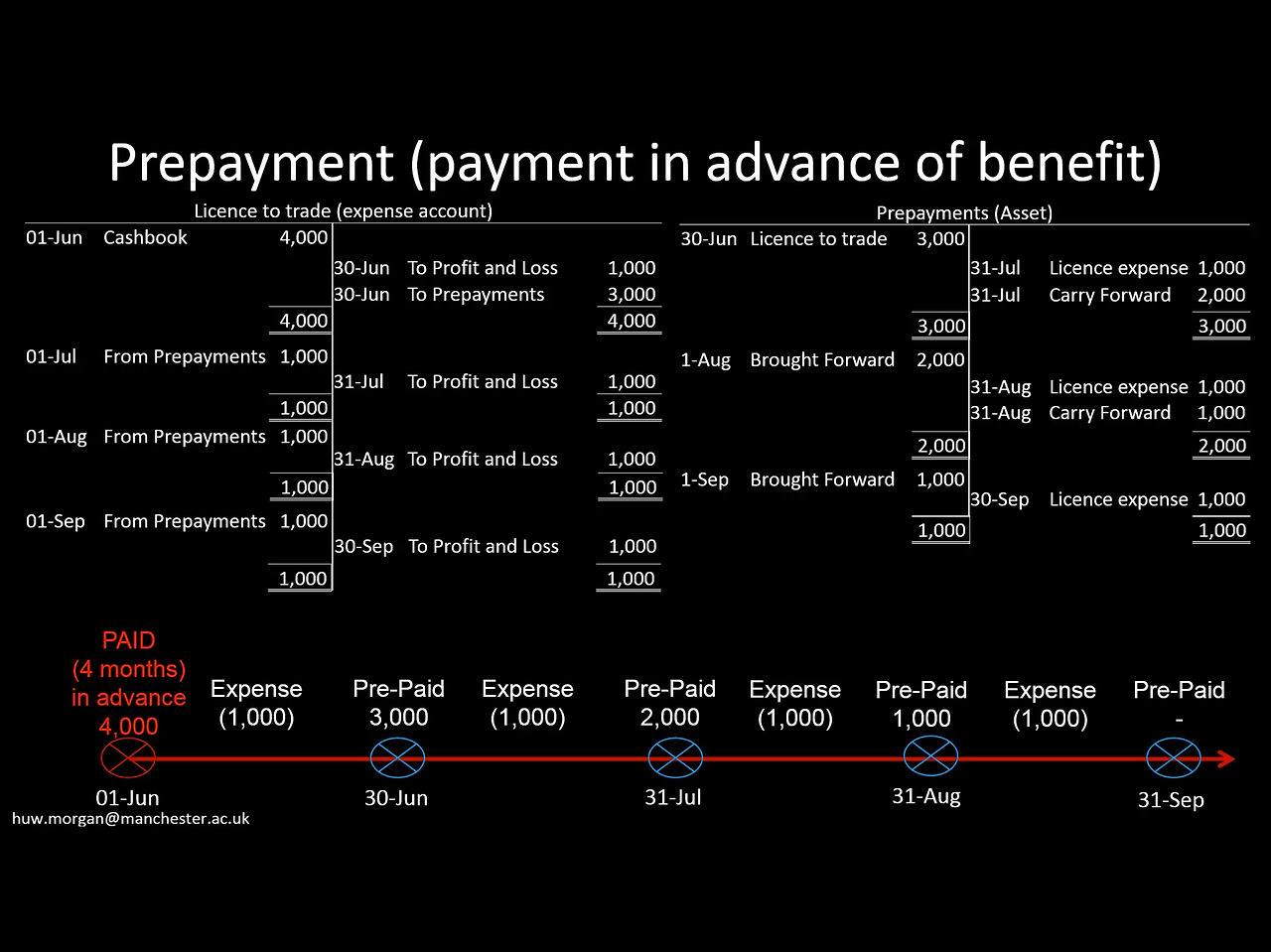

Prepayment

Prepaid Expenses: Paid in advance of benefit

ex) On 1st June Shuan paid 4,000 for a licence allowing access to festival sites for the next 4 months in advance.

Expense = Payment + Opening prepayment - Closing prepayment 이번에 사용한 금액 Payment= Expense - Opening prepayment + Closing prepayment 실제로 지금 낸 거

Accrual

Accrued Expenses: Debt for a received benefit

ex) On 31st Dec: received a bill for 500 for electricity used in December (in arrears).

Bill to be paid in January (the next accounting year)

Expense = Payment - Opening accrual + Closing accrual 현재비용

Payment = Expense + Opening accrual - Closing accrual 지금 건 나중에 낼 거고 저번 거는 지금 냈음 지불

Recording 하는 방법 2가지가 있다: 쉬우면 첫 번째, 어려우면 2번째.

- Basic Let's assume that the business has paid electricity so far in this first year of 8600. These would already be shown in the account as an expense, with a credit entry reducing cash. Shuan would then need to increase the total amount transferred to the income statement to 9100 by adding a further 500 as an accrual to be carried forward for settlement in the next accounting period. There will then be an opening balance on the electricity account, representing the amount that is outstanding at the year-end. When, on Jan 14th, the payment is then made in the next accounting period, cash will be reduced by 500, and the electricity account will be debited as in the normal accounting process. However, this payment will not be treated as an expense in the next accounting period, as it actually settles the opening balance: the accrual brought forward from the previous period, and the electricity account is now in balance and ready to record further payments relating to the correct accounting period.

- Advanced method First, be recorded in the Journal Ledger following a review of outstanding bills at the year-end. The required adjustment is to debit the electricity expense (increasing the expense) and credit accruals (increasing liabilities) in the nominal ledger. 9100 is then transferred to the income statement, representing the costs of electricity in the correct accounting period, and a current liability of 500 is shown in the statement of financial position, representing the obligation to pay the bill next year. When the next accounting year begins, the cashbook will record the subsequent payment of this bill: a credit entry will reduce cash; and when the dual transaction is recorded, this will be entered as a entry to the accruals account, canceling the liability.

- Trade Payables (매입채무):

- ABC 전자는 XYZ 공급업체에게 부품을 받았지만 아직 지불하지 않은 상태입니다.

- ABC 전자의 장부에는 아직 이 거래와 관련된 미지급금이 기록되어 있습니다.

- 이는 ABC 전자가 향후에 XYZ에게 돈을 지불해야 한다는 것을 나타냅니다.

- Accruals (미지급비용 또는 미지급수익):

- ABC 전자가 서비스를 제공하고, 그 서비스에 대한 수익을 받을 예정이지만 아직 청구서를 발행하지 않았습니다.

- 이 경우, ABC 전자는 수익을 아직 기록하지 않았지만 현재의 서비스 제공에 따라 미래에 발생할 수익을 미리 예상하고 있는 상태입니다.

- 이 미지급수익은 나중에 정확한 지불일과 함께 재무 보고서에 기록될 것입니다.

이렇게 보면 trade payables는 이미 상품이나 서비스를 받고 아직 지불하지 않은 상황을 나타내고, accruals는 아직 정확한 수익 또는 비용의 지불 시점이 정해지지 않았지만 현재의 상황에서 미래의 거래를 예상하는 상황을 나타냅니다.

Trade payables

Trade payables: what we owe our suppliers

Recognition (물건을 받으면 바로)

Dr Purchases (E🔽)

Cr Trade Payables (L⬆️)

Settlement of Trade Payable liability

Dr Trade Payables (L🔽)

Cr Cash (A🔽)

Nominal Ledger, Shuan would record all transactions with each individual supplier in the purchase ledger, with information being entered from the Purchase Daybook (which records every individual purchase) and the cashbook (where subsequent payments to suppliers are recorded). The purchase Ledger will be updated with new credit purchases from the purchase day book, whilst any payments to the supplier will also be posted to the relevant supplier accounts from the cash book. The nominal ledger will keep a total summary of the same transactions in a single, summary account - the purchase ledger control account, where the total credit purchases will be posted from the purchase day book, and the total in the period to suppliers be posted from the cash book. This memorandum recording of transactions with credit suppliers on an individual basis in the Purchase Ledger, and in total in the Nominal Ledger allows a control - or check - to be made. A total of the individual balances in the Purchase Ledger should equal the balance outstanding in the Purchase Ledger Control Account.

B/D"와 "C/D"는 각각 "Brought Down"과 "Carried Down"의 약어로서, T 계정에서 사용되는 기록의 시작과 끝을 나타냅니다.

- B/D (Brought Down):

- "B/D"는 특정 계정에 대한 이전 기간의 마감 잔액을 나타냅니다.

- 보통 T 계정의 맨 위에 위치하며, 해당 계정의 이전 기간의 잔액이 얼마였는지를 표시합니다.

- C/D (Carried Down):

- "C/D"는 특정 계정에 대한 현재 기간의 마감 잔액을 나타냅니다.

- T 계정의 맨 아래에 위치하며, 해당 계정의 현재 기간 동안의 누적된 합계를 표시합니다.

Inventory

Inventory: Valuation Issue: Cost vs NRV

“All costs of purchase, costs of conversion, and other costs incurred in bringing the inventories to their present location and condition”

DM (raw material and component parts)

- Also including insurance, handling, import duties

- Waste and scrap DL: Gross pay + NI, Pension etc

Appropriate overhead: problematic: Use a normal or planned activity

In a manufacturing business, there are more complications over the valuation of inventory, since in addition to the material costs, Shuan includes labor costs in making finished goods and an appropriate element of overheads. OHs: IC associated with manufacturing, factory rent, and rates, power, machine depreciation. There’s also an argument for including other admin OHs if directly related to production, such as office costs. So in reality, additional costs would be added to the cost of materials in the factory inventory store cards - and accounting records - to arrive at Shuan’s value of finished goods. Using a ledger system, Shuan can monitor his inventory levels at any time, and check their accuracy by carrying out spot-check stock counts. Reconciling physical inventory to accounting records is a key internal control, which can prevent theft, or check against obsolescence (in this case, food getting close to use-by date). Obsolete or worthless items will need to be removed from the inventory records if thrown away, or their value reduced in line with the concepts of impairment.

Inventory Value: lower of either cost or fair value less selling costs = net realizable value.

Journal to correct:

Dr CoS (reducing GP)

Cr Inventory

ex) H Ltd bought inventory for $530 (excluding delivery fees of $30). Demand is low, and H Ltd feels it would only be able to sell the inventory for $550, although H Ltd would incur $60 delivery costs and $30 advertising relating to the disposal. What is the inventory value?

→ $460: Inventory value is: lower of cost ($530+$30) [Include direct delivery cost] = $560, and NRV = (550-60-30)=$460. Include all DIRECT costs in the initial value, and DEDUCT any direct selling costs from the “gross” sales price to get to “net” NRV.

An impairment adjustment arises when the carrying value no longer represents the future economic benefit expected from either using it or selling it. In the case of inventory, there is no value in use - the inventory has one sole purpose: to be sold. so inventory must be valued at the lower of cost (including costs associated with bringing the inventory to its present location and condition) and the Net realizable value - the amount that SHuan considers he’d receive from selling the inventory, after any costs required to get the inventory to a saleable condition, and other selling costs like advertising. Any reduction to the value of inventory will be shown in the income statement as an expense (normally within the cost of sales).

Trade Receivables: Bad Debts

The aging schedule and other information on customers are used to consider whether Trade Receivables fairly represent assets from which future economic benefit is expected. For example, on 31st Dec 2016, Customer Y owed Shuan 2000 for over half a year, despite Shuan’s best efforts to recover it. If legal fees exceed 2000 Shuan would probably decide to write the balance off as a bad debt. This would be equivalent to ripping the page containing customer Y’s details out of the Sale Ledger: There’s no point in maintaining the record once you’re certain the customer will never pay: it’s no longer an asset. So Shuan will Credit Customer Y’s account with 2000 - removing the asset from trade receivables and show this as an expense in the income statement: as a bad debt.

Trade Receivables: Doubtful Debts

In addition to removing this bad debt from his sales ledger and the sales ledger control account in the nominal ledger, Shuan thinks there will probably be other trade receivables who might be unable to pay, based on his past experience. Such “Doubtful debts” should be adjusted for: there is doubt that the current value is fully recoverable. However, removing them from the individual accounts in the sales ledger would be impossible unless the payees can be identified specifically - and even then, if Shuan tore these unlikely payers’ pages from the sales ledger, and then a while later they ended up paying him: how would he know whether the payment received was correct? Instead of removing doubtful debts from the sales ledger control account, a separate account in the nominal ledger - the “provision for doubtful debts” - records this deduction. If Shuan estimates that 5% of the remaining TR may not be paid to him based on past experience, this amounts to 2100. The correcting journal will be to charge the P/L with more bad debts. and credit a provision for doubtful debts. The debit balance on the sales ledger control account minus the credit balance on the provision for doubtful debts will then represent the 39900 worth of net TR shown in SOFP. When Shuan closes down his nominal ledger at the end of the year, the provision for doubtful debts will remain as an opening balance. When, at the end of the next financial year, SHuan reviews doubtful debts and requires a provision of - say - 3000, then the provisions will increase by 900: the difference between the new and existing provision balance. This would result in a bad debt charge in 2017 of 900 relating to the increase in provision for doubtful debts.

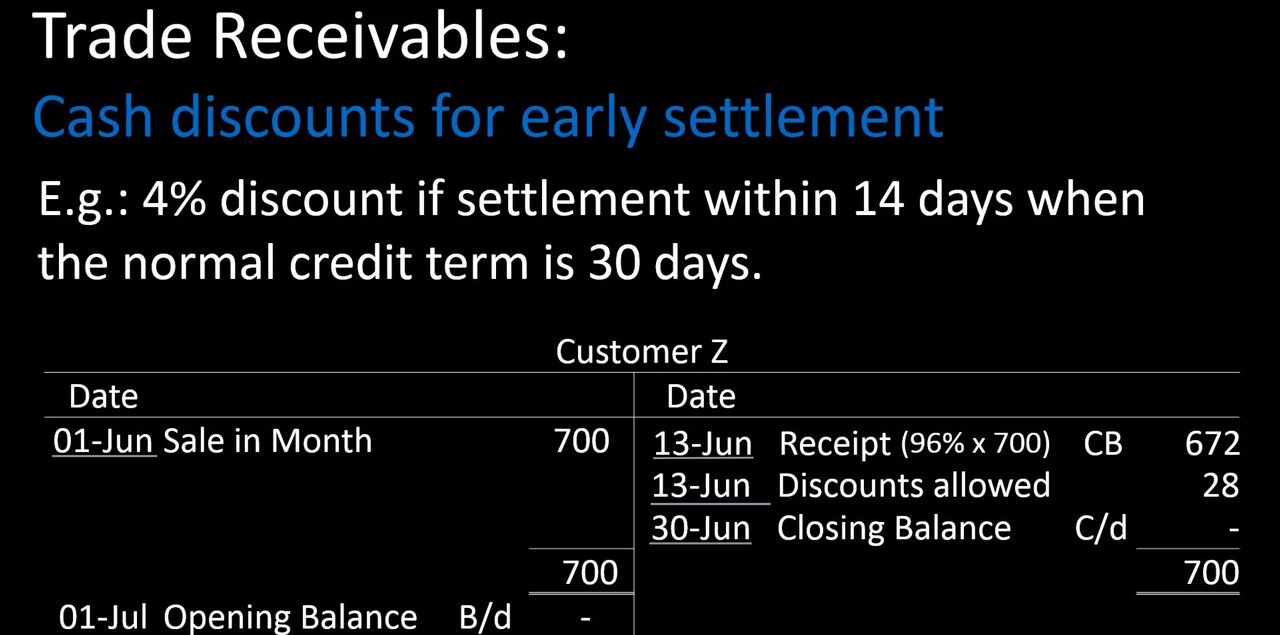

If Shuan needs cash quicker, he could offer his credit customers an early settlement discount. For example, 4% discount on the invoice value if payment is made within 2 wks. Let’s say customer Z bought goods on credit from SHuan on 1st June at a sales price of 700, and paid Shuan just within the time to claim the discount. Z would only pay 672 (deducting 4%) and then Z would have no further obligation to pay. So, Shuan would have to clear off the remaining balance, recognizing this as an expense in the P/L, called “Discount Allowed”. This would reduce Shuan’s profit - although he would benefit from receiving the lower cash amount 16 days earlier if normal terms were 30 days.

This is useful if cash is needed urgently, but probably won’t reduce the risk of bad debts: any customer struggling with cash flow issues would prefer to delay payment, or simply be unable to pay early. Shuan would need to evaluate whether the benefits of receiving cash a few weeks earlier outweigh the costs of allowing it. As well the discount expense will be the cost of managing the system: some customers may claim the discount despite not meeting the requirements - and SHuan has to decide whether to chaisng up.

ex) H opening doubtful debt (DD) provision is $2100. TR at year-end was $480,000, but $6800 of this was bad debts, and a DD provision of 3% of the remainder is required. No bad debts were recorded during the year. What is the net TR at the year's end?

: Before adjustment, TR is 480,000. Deduct the bad debts: 480,000-6,800=473,200, then deduct 3% as a provision or doubtful debts: 473,200 x 97%=459,004.

ex) H opening DD provision is $2100. TR at year-end was $480,000, but $6800 of this was bad debts and a 3% DD provision of the remainder. No bad debts were recorded during the year. What is the total expense for bad and doubtful debts in the year?

: TR less bad debts Deduct 3% as a provision for doubtful debts: 480,000-6,800= 473,200

Provision which was 2100 must be increased to 14,196: 473,200x3%=14,196

The increase is an expense: 25,196-2100=12,096

Total charge: 12,096+6,800=18,896

화이팅!

Instagram: subin_102426

'👩🎓𝐒𝐓𝐔𝐃𝐘 > 📉 Accouting & Finance' 카테고리의 다른 글

| 𝐔𝐨𝐌 BMAN 21011: Financial Markets & Institutions / 금융시스템 노트필기 (0) | 2024.02.20 |

|---|---|

| 𝐔𝐨𝐌 BMAN10552 Financial Decision making / 재무관리 필기노트 (0) | 2024.02.17 |

| 𝐔𝐨𝐌 BMAN10512 Introduction Management Account / 관리회계 필기노트 (2) | 2024.02.16 |

| 𝐔𝐨𝐌 BMAN10501 Financial Reporting / 재무회계 필기노트 (2) | 2024.02.16 |